Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global marketplace. It’s a dynamic and potentially profitable field that attracts many new investors every year. However, the vast array of trading platforms available can be overwhelming for beginners. Choosing the right platform is crucial, as it can significantly impact your trading experience and success. In this article, we’ll explore some of the best Forex trading platforms for beginners, focusing on ease of use, educational resources, customer support, and other essential features to help you start your trading journey on the right foot.

What to Look for in a Forex Trading Platform

Choosing a Forex trading platform can be daunting, especially for beginners. Here are some key features to consider:

- User-Friendly Interface: A platform with an intuitive and easy-to-navigate interface helps beginners avoid unnecessary confusion and mistakes. Look for platforms that offer clear layouts and straightforward functionalities.

- Educational Resources: Beginners benefit greatly from platforms that provide educational materials. This can include tutorials, webinars, articles, and videos that cover the basics of Forex trading and more advanced strategies.

- Customer Support: Reliable customer support is essential, especially when you encounter issues or have questions about trading. Platforms that offer 24/7 support through various channels like chat, email, and phone are preferable.

- Low Fees and Spreads: High fees and spreads can eat into your profits. Look for platforms that offer competitive pricing structures to ensure you keep more of your earnings.

- Demo Accounts: A demo account allows beginners to practice trading with virtual money before risking real capital. This feature is invaluable for gaining experience and confidence.

Top Forex Trading Platforms for Beginners

- MetaTrader 4 (MT4)

MetaTrader 4, commonly known as MT4, is one of the most popular trading platforms globally. It’s favored for its comprehensive features and user-friendly interface, making it ideal for beginners.

- Overview and Popularity: MT4 has been a go-to platform for Forex traders since its launch in 2005. It is renowned for its reliability and extensive user base.

- Key Features: MT4 offers advanced charting tools, a wide range of technical indicators, and automated trading capabilities through Expert Advisors (EAs). The platform supports multiple order types and timeframes, which is beneficial for both new and experienced traders.

- Pros and Cons for Beginners:

- Pros:

- Intuitive interface that is easy to learn

- Extensive online resources and community support

- Availability of demo accounts for practice

- Cons:

- Limited to Forex and CFDs, lacking the support for trading other asset classes

- Older technology compared to newer platforms

- Pros:

- MetaTrader 5 (MT5)

MetaTrader 5, the successor to MT4, offers enhanced features and capabilities. While similar to MT4, it provides additional tools and functionalities that can be beneficial for beginners looking to expand their trading horizons.

- Differences from MT4: MT5 supports more asset classes, including stocks, futures, and commodities. It also offers an economic calendar and improved charting tools.

- Key Features: MT5 includes advanced order management tools, an integrated economic calendar, and more timeframes and chart types. It supports automated trading and hedging, providing greater flexibility.

- Pros and Cons for Beginners:

- Pros:

- More asset classes available for trading

- Enhanced charting and analytical tools

- Improved order management and execution speed

- Cons:

- Slightly steeper learning curve compared to MT4

- Not all brokers support MT5 yet

- Pros:

- cTrader

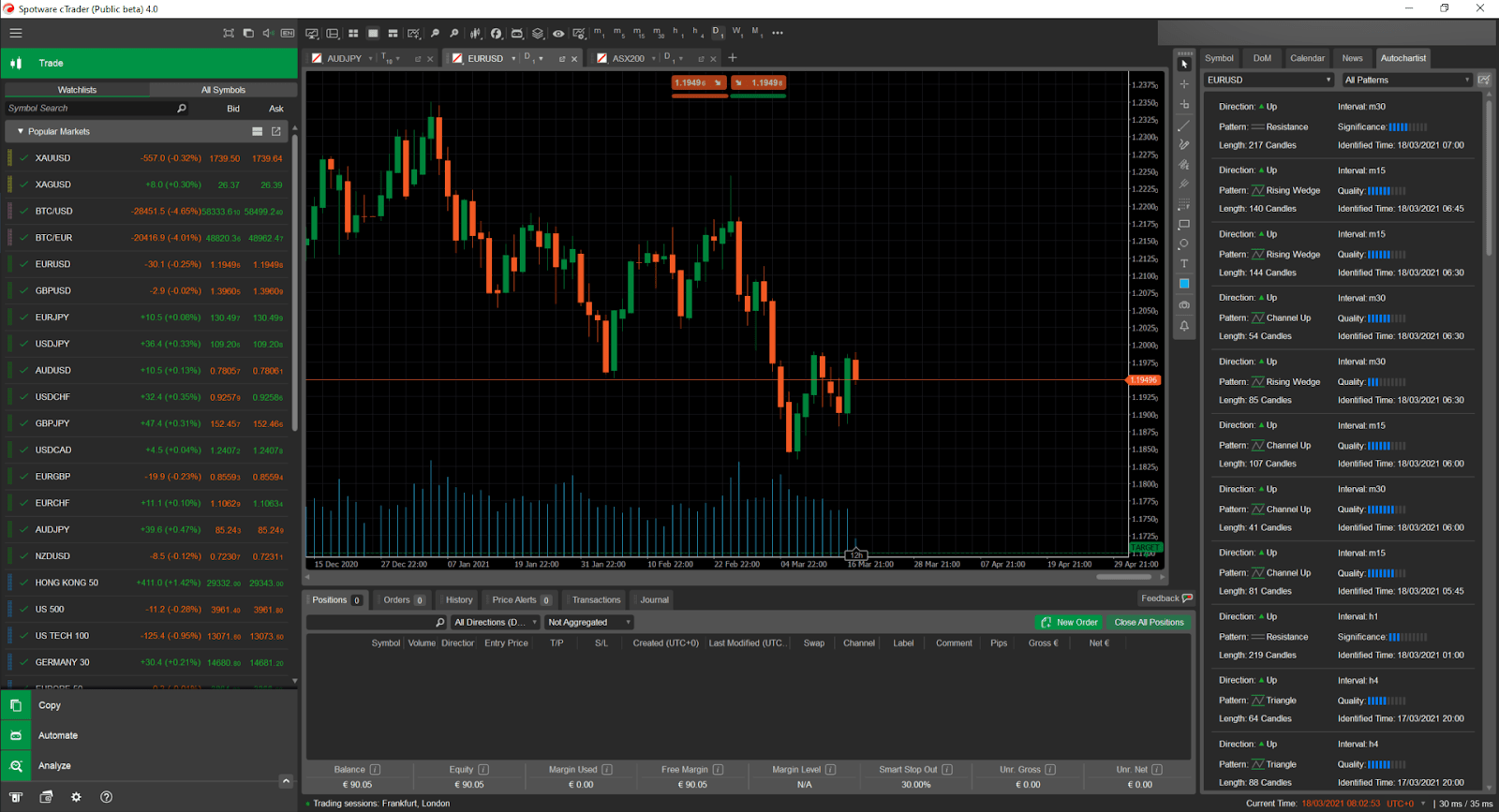

cTrader is a robust trading platform known for its user-friendly design and powerful trading tools. It’s particularly popular among traders who value transparency and direct market access.

- Overview: Launched by Spotware Systems, cTrader offers a clean and intuitive interface with a focus on providing direct access to the market.

- Key Features: cTrader boasts advanced charting tools, a wide range of technical indicators, and Level II pricing. It supports automated trading through cAlgo and offers customizable workspaces.

- Pros and Cons for Beginners:

- Pros:

- User-friendly and visually appealing interface

- Transparent pricing with direct market access

- Comprehensive charting and analysis tools

- Cons:

- Fewer educational resources compared to MT4 and MT5

- Limited broker support

- Pros:

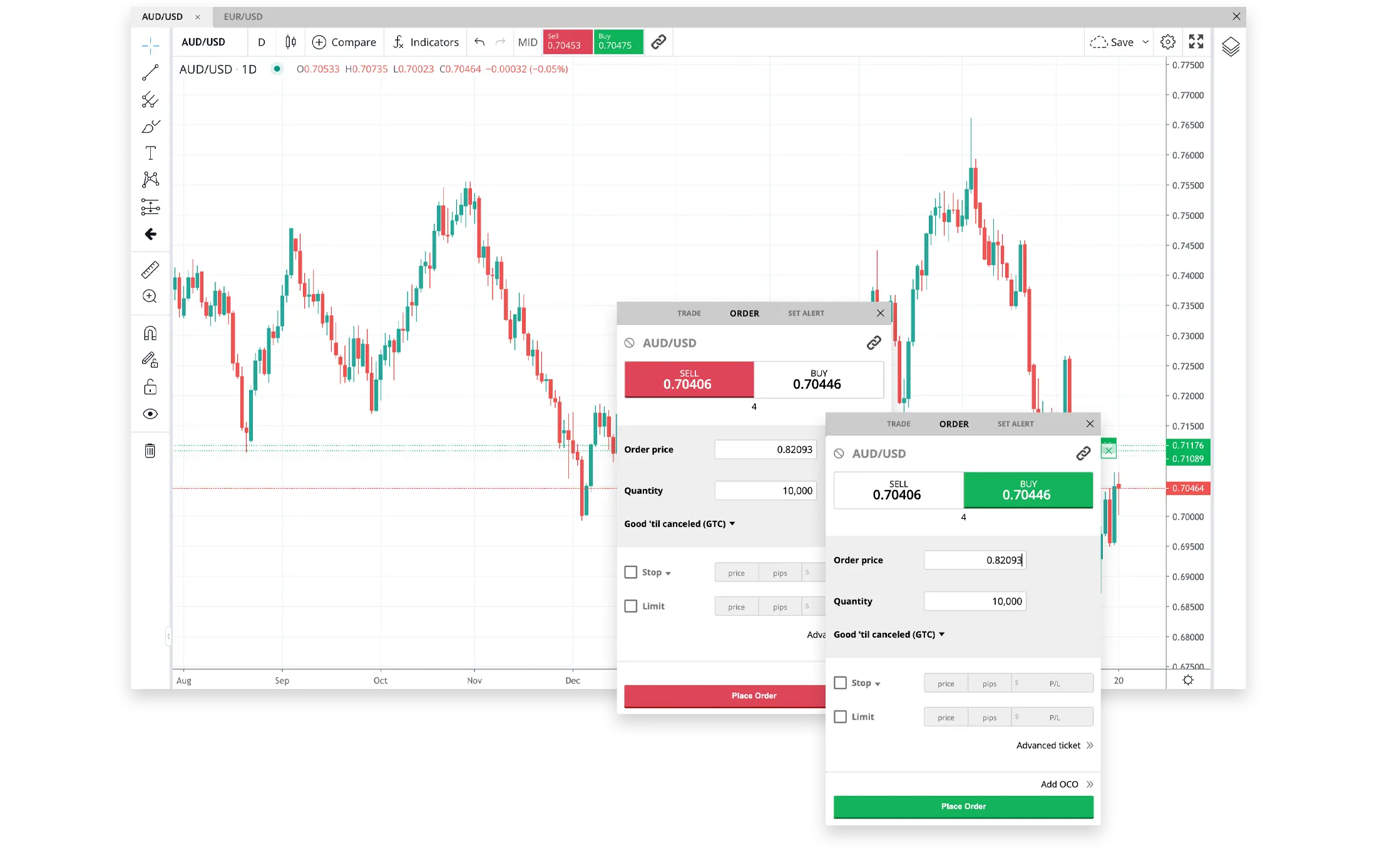

- Forex.com

Forex.com is a leading Forex broker that offers a proprietary trading platform tailored for beginners. It’s known for its educational resources and strong regulatory oversight.

- Overview: Forex.com provides a secure trading environment with a variety of trading platforms, including its proprietary web-based platform, MetaTrader, and mobile apps.

- Key Features: The platform offers advanced charting tools, a range of technical indicators, and customizable trading interfaces. It also provides extensive educational resources, including webinars, tutorials, and market analysis.

- Pros and Cons for Beginners:

- Pros:

- Comprehensive educational materials and customer support

- Competitive pricing and tight spreads

- User-friendly proprietary platform and mobile apps

- Cons:

- Limited asset classes beyond Forex

- Proprietary platform may lack some advanced features of MT4/MT5

- Pros:

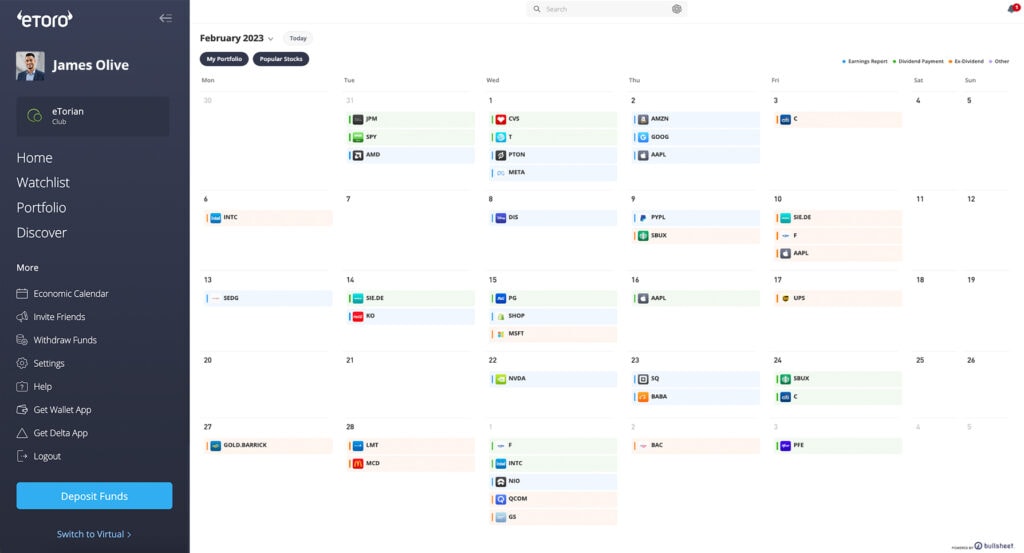

- eToro

eToro is a social trading platform that allows beginners to learn from and copy the trades of more experienced traders. It’s unique in its approach to making trading more accessible and interactive.

- Overview: eToro combines traditional trading with social networking, offering a platform where users can follow and copy successful traders.

- Key Features: eToro offers social trading, a user-friendly interface, and a range of financial instruments including Forex, stocks, and cryptocurrencies. The platform also provides educational resources and a demo account.

- Pros and Cons for Beginners:

- Pros:

- Social trading feature allows beginners to learn and replicate trades

- Intuitive and easy-to-use platform

- Diverse range of tradable assets

- Cons:

- Higher spreads compared to other platforms

- Limited customization and advanced trading tools

- Pros:

Tips for Getting Started with Forex Trading

- Practice with Demo Accounts: Before risking real money, use a demo account to practice trading. This helps you understand how the platform works and develop trading strategies without financial risk.

- Continuous Learning and Education: The Forex market is constantly evolving. Make use of the educational resources provided by your trading platform and stay updated with market news and trends.

- Risk Management Strategies: Implement risk management techniques such as setting stop-loss orders and limiting the amount of capital you risk on each trade. This helps protect your investment and minimizes potential losses.

Conclusion

Choosing the right Forex trading platform is a crucial step for beginners. Platforms like MetaTrader 4, MetaTrader 5, cTrader, Forex.com, and eToro offer various features tailored to help new traders succeed. By starting with a demo account, taking advantage of educational resources, and practicing sound risk management, beginners can build a solid foundation for their trading journey. Remember, the right platform can make a significant difference in your trading experience and success, so take the time to choose the one that best fits your needs and goals.