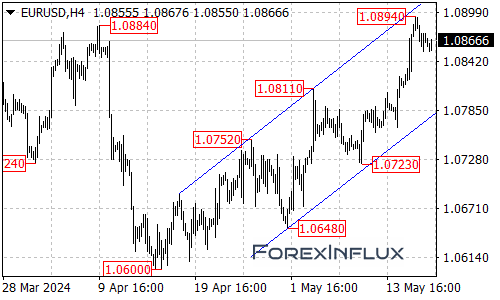

The EUR/USD currency pair has recently encountered resistance at the top of the rising price channel on the 4-hour chart, pulling back from 1.0894 level. This rejection has led to a pullback, suggesting that a consolidation phase for the broader uptrend from the 1.0600 low is currently underway.

In the near term, another decline towards the bottom of the rising price channel is likely to be witnessed in the coming days. The initial support level for the EUR/USD is situated at 1.0820. A breakdown below this level could potentially trigger further downside momentum, potentially leading the pair towards the lower boundary of the rising channel.

However, it’s crucial to note that as long as the channel support holds firm, the overall bias remains skewed towards the upside. In this scenario, the upside move from the 1.0600 low could potentially resume, with the potential for further gains towards the psychologically important 1.1000 level after the current consolidation phase concludes.

On the upside, the immediate resistance for the EUR/USD is located at the 1.0894 level. A decisive breakout above this level could potentially signal a resumption of the broader uptrend, with the next target for the bulls being the 1.0950 area.

If the EUR/USD manages to surpass the 1.0950 resistance, it could potentially pave the way for a move towards the 1.1000 level, which could act as a significant target for the bulls.

In summary, the EUR/USD is currently undergoing a consolidation phase within the confines of a rising price channel on the 4-hour chart. While further declines towards the bottom of the channel are likely in the near term, the overall upside potential remains intact as long as the channel support holds firm.

Traders and investors should closely monitor the price action around the 1.0820 support level, as well as the 1.0894 and 1.0950 resistance levels, to gauge the potential direction of the EUR/USD in the coming days.