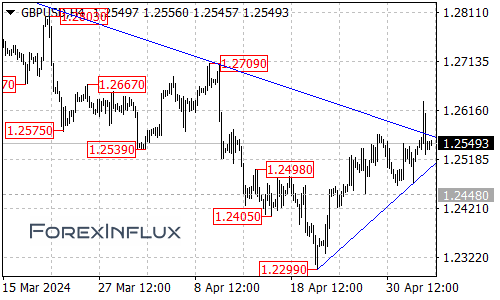

The British pound has witnessed a significant development against the US dollar, with the GBP/USD currency pair breaking above the falling trend line on the 4-hour chart. This bullish breakout suggests that the previous downside move from the 1.2893 level has likely completed at the 1.2299 low.

With this development, the initial support for the GBP/USD is now located at the rising trend line on the 4-hour chart. As long as this trend line support holds firm, the upside move from the 1.2299 level could potentially continue, with the next target for the bulls being around the 1.2700 level.

If the GBP/USD manages to surpass the 1.2700 resistance, it could potentially trigger further upside momentum, potentially paving the way for a move towards the 1.2800 level.

However, traders should also remain vigilant for potential downside risks. If the GBP/USD breaks down below the rising trend line support, it could potentially lead to a pullback towards the next support level at 1.2448.

It’s important to note that only a decisive break below the 1.2448 level could potentially signal a more significant bearish reversal, potentially triggering another decline towards the previous low of 1.2299.

In summary, the GBP/USD has staged a bullish breakout above the falling trend line on the 4-hour chart, suggesting that the previous downtrend may have concluded. As long as the rising trend line support holds, further upside momentum could be on the cards, with the 1.2700 and 1.2800 levels acting as potential targets for the bulls.

However, traders should remain cautious and closely monitor the price action around the rising trend line support and the 1.2448 level, as a breakdown below these levels could potentially negate the bullish outlook and potentially pave the way for a move back towards the 1.2299 low.

Traders and investors are advised to stay vigilant and adapt their strategies based on the evolving price action in the GBP/USD currency pair.