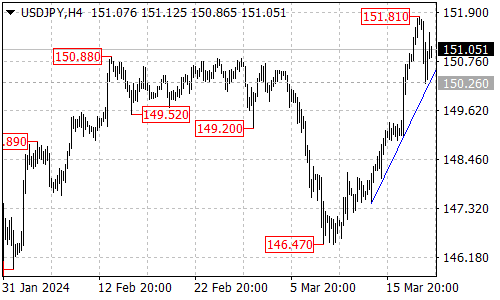

The USDJPY pair has recently experienced a pullback, capturing the attention of traders and analysts alike. After reaching a high of 151.81, the pair has retreated to as low as 150.26, facing a crucial support level – the rising trend line on the 4-hour chart.

Trend Line Support: A Pivotal Level

As the pair navigates this consolidation phase, all eyes are on the rising trend line support. As long as this support level holds firm, the pullback from 151.81 could be treated as a healthy consolidation within the broader uptrend that originated from the 146.47 level.

Upside Potential and Targets

If the trend line support remains intact, traders believe that further upside momentum is still possible, with the pair potentially targeting the significant 170.00 area after the current consolidation phase.

Key Support and Potential Reversal

While the uptrend remains in focus, traders will be closely monitoring the key support level at 150.26. A breakdown below this level could potentially signal the completion of the uptrend from 146.47, potentially paving the way for a bearish reversal.

In such a scenario, the next target area for the bears would be the 149.00 level, indicating a potential shift in the overall trend dynamics.

Key Levels to Watch

In this volatile phase, traders will be keeping a close eye on the following key levels:

- Rising trend line (current support)

- 150.26 (key support)

- 170.00 (potential upside target)

- 149.00 (potential downside target)

The price action around these levels will be instrumental in determining the pair’s next move and the potential for a continuation of the uptrend, a consolidation phase, or a potential reversal.