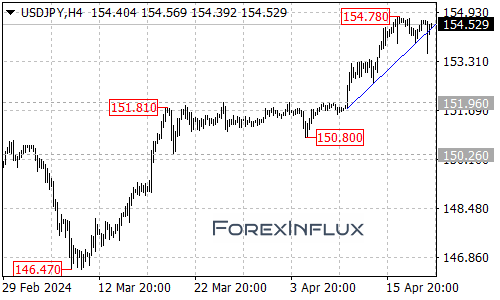

The USDJPY currency pair has taken a bearish technical turn by breaking below the rising trendline support visible on the 4-hour chart timeframe. This trendline breakdown suggests that a lengthier period of consolidation could potentially be underway within the broader uptrend that has been tracking from the 146.47 low printed back in March.

In the wake of this trendline violation, USDJPY may find itself stuck in a trading range over the coming days and weeks. The pair seems likely to oscillate between the key 152.50 support area on the downside and the 154.78 resistance zone on the topside as it works through this consolidation phase.

However, it’s important to note that the overall longer-term bullish outlook would remain viable as long as the USDJPY is able to continue finding support in the 152.50 region. A sustained hold above 152.50 would leave the door open for the uptrend from 146.47 to potentially resume at a later stage.

In fact, if the currency pair can stabilize and muster enough strength for a breakout above the 154.78 resistance level, it could open the path for another rally leg targeting the 157.00 handle next.

But for now, the technical breakdown below the rising trendline has shifted the near-term bias to more neutral or even slightly bearish. USDJPY traders will be watching the price action around 152.50 support and 154.78 resistance closely for potential range-trading opportunities while waiting for more clarity on whether the uptrend or a deeper corrective phase will ultimately prevail.

The key levels to monitor are 152.50 support for any signs of a bullish reversal and continuation, or a breakdown below that area to signal a more significant downside move could be underway. Meanwhile, a reclaim of 154.78 resistance would be an initial step in reinstating the previously bullish technical forecast.