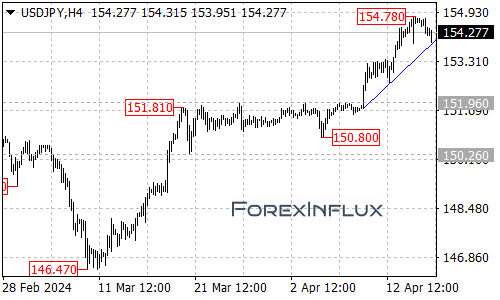

The USDJPY currency pair is currently facing an important technical test, with price action hovering near the rising trendline support visible on the 4-hour chart timeframe.

As long as this trendline support area manages to hold firm, the pullback from recent highs could be viewed as nothing more than a consolidation within the broader uptrend that has been tracking from the 150.80 low. Holding trendline support would leave the door open for a potential resumption of gains towards the 157.00 handle.

However, if USDJPY breaks decisively below the rising trendline, it would mark a more significant technical event. Such a breakdown would suggest that a deeper correction or consolidation is underway within the longer-term uptrend from the 146.47 low printed back in March.

A trendline violation could precipitate further USDJPY downside, with the next key support zone arriving in the 152.50 area in that scenario.

The price action around this rising 4-hour trendline will be critical for USDJPY traders in determining whether the pair remains in an uptrend, or if a more prolonged period of consolidation is due to unfold.

A hold above trendline support would keep the near-term technical bias tilted in favor of the bulls targeting a potential continuation higher towards the 157.00 resistance zone. Conversely, a breakdown below the trendline would flip the outlook to more neutral or even bearish in the days and weeks ahead.

USDJPY traders will want to closely monitor price behavior around the rising trendline for potential buy or sell signals depending on whether support holds or breaks. The trendline area represents a pivotal technical juncture for determining the pair’s near-term directional bias.