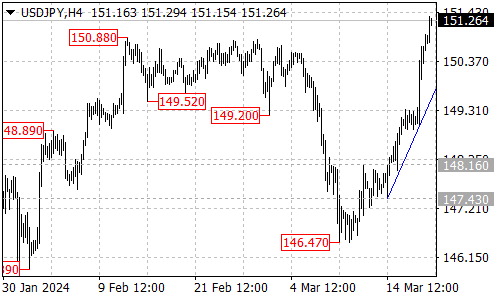

The USDJPY pair has recently experienced a significant breakout, capturing the attention of traders and analysts alike. The pair has successfully breached the 150.88 resistance level, and its upside move from 146.47 has extended to as high as 151.33, signaling a potential shift in momentum.

Bullish Momentum Gains Traction

The recent break above the 150.88 resistance has fueled speculation that the bullish sentiment surrounding the USDJPY pair could intensify further. As long as the price remains above the rising trend line on the 4-hour chart, traders believe that further upside potential exists, with the next target area being the psychologically significant 160.00 level.

Potential Consolidation Phase

While the bulls currently hold the advantage, traders will be closely monitoring the initial support level at 150.35. A breakdown below this level could potentially indicate that a consolidation phase for the uptrend from 146.47 is underway. In such a scenario, the pair would likely find support at the rising trend line, presenting a potential opportunity for buyers to re-enter the market.

Trend Line Significance

While the consolidation phase may offer temporary respite for the bears, traders will be keeping a watchful eye on the rising trend line support. Only a decisive break below this level could signal a potential completion of the broader uptrend, requiring traders to reassess their positions and strategies accordingly.

Risk Management and Opportunity

The current technical landscape for the USDJPY pair presents both opportunities and risks for traders. On one hand, a continuation of the uptrend could allow traders to capitalize on potential bullish momentum. On the other hand, a potential consolidation phase or a break below the trend line support could necessitate a reevaluation of trading strategies and the implementation of robust risk management techniques.

As the pair navigates through this crucial juncture, traders will need to remain vigilant, closely monitoring the price action and employing sound risk management strategies to effectively manage their positions.

Key Levels to Watch

In this volatile phase, traders will be keeping a close eye on the following key levels:

- Rising trend line (current support)

- 150.35 (initial support)

- 160.00 (potential upside target)

- Trend line support (critical support)

The price action around these levels will be instrumental in determining the pair’s next move and the potential for a continuation of the uptrend, a consolidation phase, or a potential reversal.

In the ever-changing world of forex trading, adaptability and discipline are key attributes for successful traders. As the USDJPY pair navigates through this bullish breakout, traders will need to remain vigilant, closely monitoring the price action and employing sound risk management strategies to navigate the challenges and capitalize on potential opportunities that may arise.