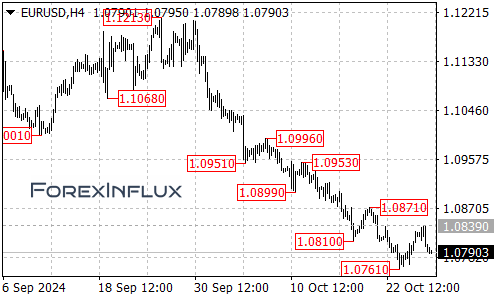

The EUR/USD currency pair has been on a notable downward swing, extending its decline from the previous level of 1.1213 down to as low as 1.0761. For traders and investors keeping a close eye on this major forex pair, understanding the key resistance and support levels is crucial for making informed decisions.

Current Market Movement

EUR/USD has been experiencing bearish momentum, pushing the pair downwards significantly. The latest movement has seen the euro weaken against the US dollar, dropping from 1.1213 to a low of 1.0761.

Key Resistance and Support Levels

At present, the key resistance level stands at 1.0839. This level is critical—if EUR/USD manages to hold this resistance, the bearish trend may continue unabated. However, should the pair break below the support level of 1.0761, we could witness further downward movement targeting the 1.0730 area.

Short-Term Outlook

Looking at the immediate future, the initial resistance is identified at 1.0800. A successful breakout above this level would be a bullish signal, potentially paving the way for the price to climb towards the main resistance at 1.0839. Surpassing this threshold would suggest that the current downward movement from 1.1213 has been exhausted, signaling a possible reversal in trend.

Potential Gains

If the EUR/USD pair manages to break through both the initial and key resistance levels, the next targets would be set at 1.0870 and subsequently the 1.0930 area. Achieving these levels would indicate a strong recovery of the euro against the dollar, presenting opportunities for traders anticipating a bullish turnaround.