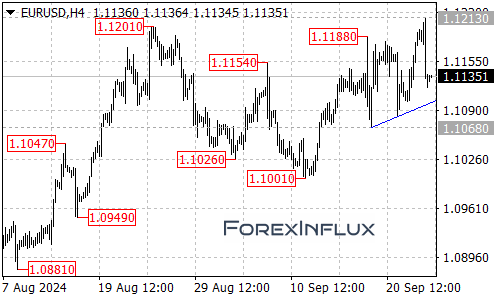

The EUR/USD pair recently broke through the 1.1200 resistance level, peaking at 1.1213 before experiencing a pullback to as low as 1.1121. This movement raises some interesting questions about the current trend and what traders might expect moving forward.

As long as the price remains above the rising trend line observed on the 4-hour chart, this pullback can be interpreted as a consolidation phase rather than a reversal. This suggests that we could see another attempt to retest the 1.1200 resistance level in the near future. If the pair manages to break past this resistance, we could be looking at an upward trajectory towards the 1.1250 area, followed by a potential move to 1.1300.

However, it’s essential to keep an eye on the downside as well. Should the price break below the rising trend line, we may see a test of the key support level at 1.1068. A drop below this level could indicate a more significant shift in the market, potentially signaling the end of the current uptrend.

In summary, while the recent pullback may seem concerning, there’s still room for optimism if the EUR/USD can maintain its position above critical support levels. Traders should stay vigilant and monitor these key areas as the market continues to evolve.