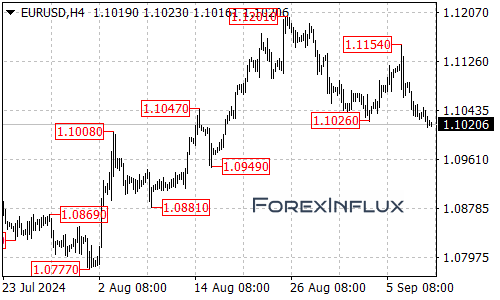

The EURUSD has just broken below the critical support level of 1.1026. This breakdown is a significant event that could shape the pair’s trajectory in the coming days.

What This Means for Traders

The breach of this key support level signals a potential shift in market sentiment. It suggests that bears are currently in control and could drive prices lower. However, as always in forex trading, it’s essential to consider multiple scenarios.

Potential Downside Targets

Given the recent breakdown, here are the key levels traders should watch:

- Immediate Target – 1.1000 Area:

- This psychologically important round number is likely to be the next focal point for traders.

- It could act as a magnet for price action in the short term.

- Secondary Support – 1.0960:

- If the 1.1000 level fails to hold, this is the next significant support to watch.

- A break below this level would confirm the bearish trend.

- Major Support Zone – 1.0900 Area:

- This represents a more substantial support area.

- Reaching this level would indicate a significant bearish move and could attract buyers looking for a potential reversal.

Potential for Upside Movement

While the current momentum appears bearish, it’s crucial to be prepared for potential reversals:

- Initial Resistance – 1.1050:

- This is now the first hurdle for any upward movement.

- A break above this level could signal a short-term reversal of the bearish trend.

- Key Resistance – 1.1090 Area:

- If buyers manage to push past 1.1050, this becomes the next significant level to watch.

- Overcoming this resistance could indicate a more substantial shift in sentiment.

- Major Resistance – 1.1154:

- This level represents a significant previous high.

- A move to this point would suggest a complete reversal of the current bearish trend.

Conclusion

The EURUSD pair is at a critical juncture following the breakdown below 1.1026. While the immediate outlook appears bearish, forex markets are known for their ability to surprise.

Traders should keep a close eye on the key levels mentioned, particularly the 1.1000 area, which could prove to be a battleground between bulls and bears. As always, combining this Forex technical analysis with fundamental factors and overall market sentiment will provide the most comprehensive trading approach.