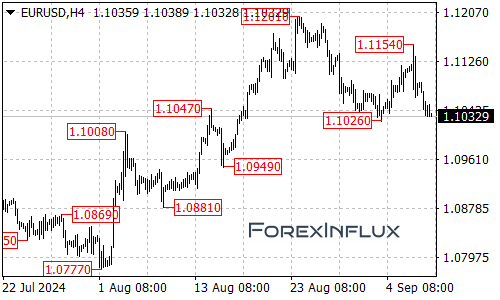

As of now, EURUSD is testing a significant support level at 1.1026. This level is acting as a battleground between bulls and bears, and its outcome could set the tone for the pair’s next major move.

Potential Downside Scenarios

If the bears take control, here’s what traders should be prepared for:

- Breaking Below 1.1026: A decisive move below this support could open the floodgates for further selling pressure.

- Next Target – 1.1000: The psychological level of 1.1000 becomes the next focal point. This round number often acts as a magnet for price action and could see increased trading activity.

- Further Downside Potential:

- If 1.1000 fails to hold, watch for a move towards 1.0960.

- Beyond that, the 1.0900 area comes into play as a more significant support zone.

Upside Potential

While the immediate picture may seem bearish, it’s crucial to consider potential bullish scenarios:

- Initial Resistance – 1.1055: This is the first hurdle for any upward movement. A break above this level could shift short-term sentiment.

- Key Level – 1.1090: If buyers push past 1.1055, the 1.1090 area becomes the next important resistance to watch.

- Previous High – 1.1154: This level represents a recent high and could be targeted if bullish momentum builds significantly.

Conclusion

The EURUSD pair is at a critical juncture, with important levels on both the upside and downside. Whether you’re a day trader or a longer-term investor, understanding these key levels can help inform your trading decisions.

Remember, while forex technical analysis provides valuable insights, it’s always important to consider fundamental factors and overall market sentiment in your trading strategy.