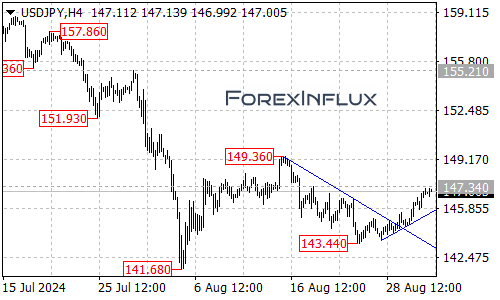

The USDJPY pair has rallied significantly from its recent low of 143.44 and is now testing a crucial resistance level. This situation presents both opportunities and risks for traders, depending on how price action unfolds in the coming sessions.

Key Levels to Watch

Resistance Levels

- 147.34: This is the immediate and crucial resistance level. How the price reacts here could determine the short-term direction.

- 149.36: If 147.34 is breached, this becomes the next significant target for bulls.

Support Levels

- 146.55: The initial support to watch if the current resistance holds.

- Rising Trend Line: Visible on the 4-hour chart, this serves as a dynamic support level.

- 143.44: The recent low, which could come into play if we see a significant reversal.

Potential Scenarios

Bullish Case

The current test of resistance at 147.34 is critical. Here’s what could support further upside:

- A decisive break above 147.34 could trigger a fresh wave of buying.

- In this scenario, expect the next significant resistance to emerge around 149.36.

Bearish Case

Despite the recent uptrend, there’s always potential for a pullback or reversal:

- If 147.34 holds as resistance, we might see a retreat to 146.55.

- A break below 146.55 could lead to a test of the rising trend line visible on the 4-hour chart.

- Only a decisive break below this trend line would suggest that the upward move from 143.44 has completed, potentially paving the way for a revisit of that level.

Conclusion

The USDJPY pair stands at a critical point, testing the 147.34 resistance level. A break above this level could open the door for a move towards 149.36, while a rejection might lead to a pullback towards 146.55 or even the rising trend line.

Traders should remain vigilant, watching for clear breakouts or rejections at these key levels. Remember that while technical analysis provides valuable insights, unexpected news or economic data can quickly change the market dynamics.