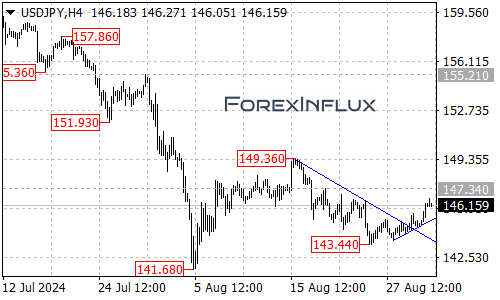

The USDJPY pair has recently broken above a key falling trend line visible on the 4-hour chart. This technical event suggests that the downside move from the recent high of 149.36 may have found its bottom at 143.44. Such a breakout often signals a potential trend reversal, making it a crucial moment for traders to reassess their positions and strategies.

Technical Analysis: Key Levels to Watch

Resistance Levels

- 147.34: This is the immediate key resistance level. A break above this could accelerate the bullish momentum.

- 149.36: The previous high, now serving as a significant resistance point.

Support Levels

- 145.55: The initial support level to watch in case of a pullback.

- Rising Trend Line: This newly formed trend line on the 4-hour chart is now acting as dynamic support.

- 143.44: The recent low, now serving as a crucial support level.

Potential Scenarios

Bullish Case

The trend line breakout suggests a bullish bias. Here’s what could support further upside:

- As long as the price remains above the rising trend line, the upward move from 143.44 is likely to continue.

- The next significant target is the 147.34 resistance level.

- A break above 147.34 could pave the way for a test of the previous high at 149.36.

Bearish Case

While the overall bias has shifted to bullish, it’s important to consider potential reversals:

- A drop below 145.55 could lead to a test of the rising trend line support.

- A breakdown below the rising trend line could signal a false breakout, potentially bringing the price back towards the 143.44 support.

Conclusion

The USDJPY pair has shown a significant technical development with its break above the falling trend line on the 4-hour chart. This suggests that the recent downtrend may have concluded, opening the door for potential bullish moves towards 147.34 and possibly 149.36.

However, traders should remain vigilant. The forex market can be unpredictable, and it’s crucial to watch how the price reacts at key levels. The 145.55 support and the rising trend line will be important to monitor for any signs of weakness in this newfound bullish momentum.