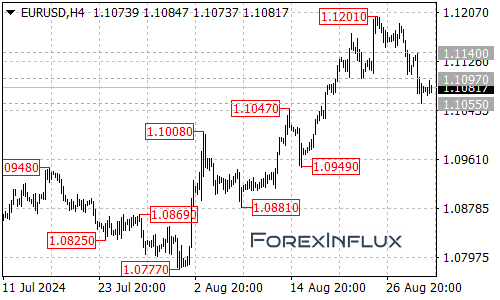

The EURUSD pair has been on a downward trajectory, falling from a recent high of 1.1201. This decline has extended to a low of 1.1055, a level that’s now under close scrutiny by traders and analysts alike.

Technical Analysis: Key Levels to Watch

Support Levels

- 1.1055: This is the current key support level. How the price reacts here could determine the short-term direction.

- 1.0985: If 1.1055 fails to hold, this becomes the next significant support target.

Resistance Levels

- 1.1105: The initial hurdle for any potential recovery.

- 1.1140: A break above 1.1105 could see the price push towards this level.

- 1.1201: The previous high, now serving as a significant resistance point.

Potential Scenarios

Bearish Case

The current downtrend suggests further decline is possible. Here’s what could support continued downside:

- A breakdown below the 1.1055 support could accelerate the decline.

- In this scenario, expect the next significant support to emerge around the 1.0985 area.

Bullish Case

Despite the current downtrend, there’s always potential for a reversal. Here’s what could signal an upward move:

- A break above the initial resistance at 1.1105 could trigger a recovery.

- Clearing 1.1140 would strengthen the bullish case.

- A move above 1.1201 (the previous high) would suggest a potential trend reversal.

Conclusion

The EURUSD pair is currently in a downtrend, having fallen from 1.1201 to a low of 1.1055. While further decline is possible, with 1.0985 being the next significant support level to watch, traders should also be prepared for potential bullish reactions, especially if the price breaks above key resistance levels.