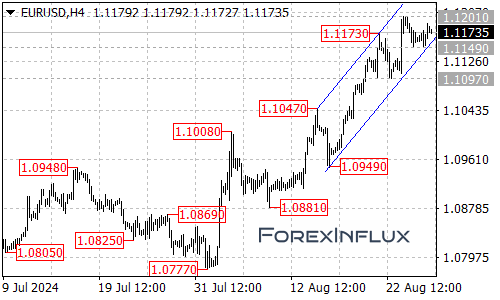

For the past two days, the EURUSD pair has been trading in a narrow range between 1.1149 and 1.1201. This sideways movement comes after a notable uptrend that began at 1.0881, suggesting a potential period of consolidation.

Technical Analysis: The Bigger Picture

Despite the current consolidation, it’s crucial to view this in the context of the larger trend. The EURUSD pair is still within a rising price channel visible on the 4-hour chart. This overarching structure provides valuable insights for traders.

Bullish Scenario

As long as the price remains within this ascending channel, the current sideways movement can be interpreted as a consolidation phase within the broader uptrend. Here’s what traders should watch for:

- Immediate Target: Once the consolidation phase concludes, we could see a push towards the 1.1300 area.

- Extended Target: If bullish momentum persists beyond 1.1300, the next significant level to watch would be around 1.1450.

Support Levels to Monitor

While the overall trend remains bullish, it’s crucial to keep an eye on potential support levels:

- Channel Support: The lower boundary of the rising channel is a key level to watch. A break below this could signal a shift in the short-term trend.

- Key Support Levels:

- 1.1149: This level marks the bottom of the current consolidation range.

- 1.1097: A more significant support level that, if breached, could indicate a deeper retracement.

Trading Implications

- Range Trading: In the short term, traders might consider range-trading strategies between 1.1149 and 1.1201.

- Breakout Opportunities: Watch for a decisive break above 1.1201, which could signal the end of consolidation and continuation of the uptrend.

- Risk Management: Place stops below the channel support or 1.1149, depending on your risk tolerance and trading timeframe.

Conclusion

The EURUSD pair is currently in a consolidation phase, trading sideways between 1.1149 and 1.1201. However, this consolidation is occurring within a broader uptrend, as evidenced by the rising channel on the 4-hour chart. Traders should remain vigilant for a potential breakout, which could lead to a move towards 1.1300 and possibly 1.1450.

On the flip side, a breakdown below the channel support and subsequently below 1.1149 could signal a deeper retracement, with 1.1097 being the next key support to watch.