The Euro to US Dollar exchange rate (EUR/USD) has been on a strong upward trajectory, and the latest developments are quite exciting for traders. Let’s dive into the details.

Breakthrough at 1.1100

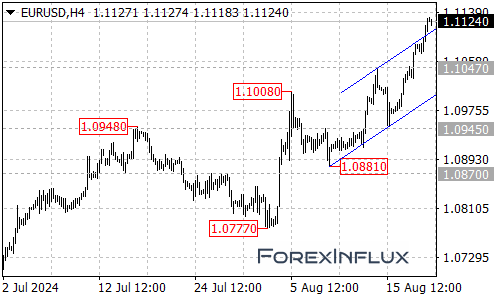

EUR/USD has extended its upward move from the 1.0777 level, reaching as high as 1.1132. This is a significant milestone, as the pair has now successfully broken above the 1.1100 resistance level.

What’s Next for the Pair?

The current momentum suggests that further upside could be in the cards, but we may see a minor consolidation period first. Here’s what to watch for:

- Potential Target: 1.1200 If the bullish trend continues after a brief pause, 1.1200 could be the next target for EUR/USD.

- Key Support Level: 1.1095 This will be an important level to monitor. A breakdown below 1.1095 could signal a period of consolidation.

The Bigger Picture

Examining the 4-hour chart, we can see that EUR/USD has been trading within a rising price channel. This is a bullish sign, as it indicates a well-defined uptrend.

Trading Implications

- For Bulls:

- Look for opportunities to enter long positions on pullbacks towards the channel’s support.

- Consider setting targets around the 1.1200 level.

- Use the channel’s lower boundary as a guide for stop-loss placement.

- For Bears:

- The current trend suggests caution is needed for short positions.

- Keep a close eye on the 1.1095 support level. A breakdown below this could open the door for short-term bearish trades.

- However, be mindful of the overall uptrend and the channel’s support as a potential floor for the pair.

Key Takeaways

- EUR/USD has broken above the 1.1100 resistance level, reaching a high of 1.1132.

- The next target for bulls is 1.1200, but a minor consolidation period may occur first.

- The 1.1095 level is a crucial short-term support to watch.

- The rising price channel on the 4-hour chart confirms the overall bullish trend.

Remember, forex markets can be volatile, and it’s essential to use proper risk management techniques. Stay informed about economic developments that could impact the Euro and US Dollar.