The Euro to US Dollar exchange rate (EUR/USD) has made some significant moves recently. Let’s break down what’s happening and what it could mean for traders in the coming days.

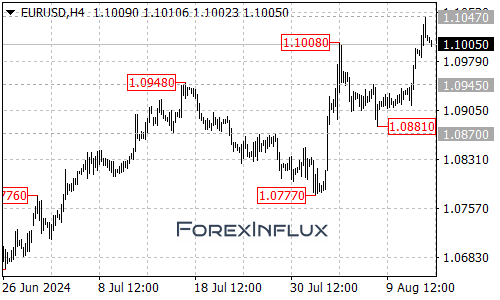

Recent Breakthrough EUR/USD has successfully broken above the key 1.1008 resistance level, extending its upward move from the 1.0777 low to reach a new high of 1.1047. However, we’re now seeing a bit of a pullback, which suggests we might be entering a consolidation phase.

What to Expect in the Coming Days It looks like we’re in for some range-bound trading. Here’s what to watch for:

- Trading Range: Expect the pair to move between 1.0945 and 1.1047 in the short term.

- Key Support: 1.0945 is the level to watch. If the price stays above this, the upward trend is likely to continue.

- Potential Target: If we break above 1.1047, the next major target would be the 1.1100 area.

Key Levels to Monitor

Resistance:

- Current High: 1.1047

- Next Target: 1.1100

Support Levels:

- Initial Support: 1.0985

- A drop below this could lead to a test of the lower range.

- Key Support: 1.0945

- This is crucial. A break below could signal a deeper pullback.

- Major Support: 1.0900

- If 1.0945 breaks, this could be the next significant level to watch.

Trading Implications

- For Bulls:

- Look for opportunities to enter long positions on pullbacks to support levels.

- Consider setting targets around the 1.1100 level if we break above 1.1047.

- For Bears:

- The overall trend is still up, so be cautious with short positions.

- Watch for a potential break below 1.0945 as a signal for possible short entries.

Key Takeaways

- EUR/USD is in a consolidation phase after reaching a new high of 1.1047.

- Expect range-bound trading between 1.0945 and 1.1047 in the near term.

- The overall trend remains bullish as long as the price stays above 1.0945.

- A break above 1.1047 could open the door to further gains towards 1.1100.

Remember, forex markets can change quickly. Always use proper risk management techniques and stay informed about economic events that could impact currency movements.

We’ll continue to monitor EUR/USD and provide updates as the situation evolves. Happy trading!