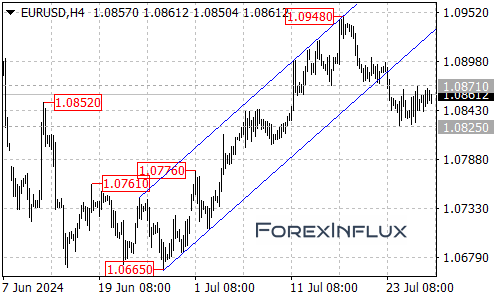

The EURUSD pair has been caught in a sideways trading pattern for several days, oscillating between 1.0825 and 1.0870. This range-bound movement suggests a period of consolidation as traders await a clear directional signal.

Current Situation

At present, EURUSD is testing a crucial resistance level at 1.0870. This level is key to determining the pair’s short-term direction.

Key Levels to Watch

Resistance Levels:

- 1.0870 (Current resistance)

- 1.0900

- 1.0920

Support Levels:

- 1.0840 (Initial support)

- 1.0825

- 1.0800 area

Potential Scenarios

Bullish Scenario

If EURUSD manages to break above the 1.0870 resistance, it could signal the completion of the recent downward move from 1.0948. In this case, we might expect the following:

- Initial target: 1.0900 area

- Secondary target: 1.0920 area

This breakout would suggest a shift in momentum to the upside, potentially opening the door for further gains.

Bearish Scenario

On the other hand, if the pair fails to breach the 1.0870 resistance and instead falls below the initial support at 1.0840, we could see:

- A test of the lower range boundary at 1.0825

- If 1.0825 doesn’t hold, the next target would be the 1.0800 area

A move below 1.0825 would indicate that the bearish pressure remains strong and could lead to further downside.

Conclusion

The EURUSD pair is at a critical juncture. The breakout from the current trading range will likely determine the short-term direction. Traders should keep a close eye on the key levels mentioned, particularly 1.0870 on the upside and 1.0840 on the downside.

As always, it’s important to consider broader economic factors and news events that could influence the EURUSD pair. Stay informed and practice sound risk management in your trading decisions.