On Tuesday, July 16th, the AUD/USD pair experienced a 0.4% decline, closing at 0.6733. During the trading session, it touched a low of 0.6712. This drop has left many Aussie bulls concerned about the currency’s near-term prospects.

Key Factors Influencing the Aussie Dollar

- Strengthening US Dollar:

- The continued rebound of the US dollar put pressure on the AUD/USD pair.

- Weak Chinese Economic Data:

- China’s second-quarter GDP data came in softer than expected, negatively impacting the Aussie due to Australia’s close economic ties with China.

- Commodity Price Declines:

- Significant drops in copper, iron ore, and oil prices weighed heavily on the commodity-linked Australian dollar.

- Diverging Central Bank Expectations:

- The differing rate outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve are helping to limit the Aussie’s downside.

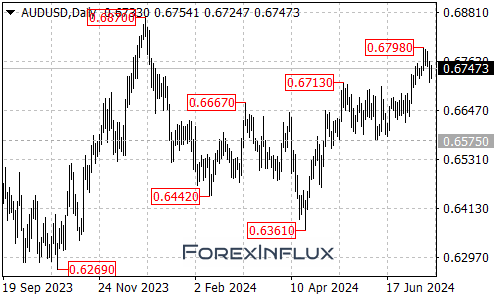

Technical Analysis

Daily Chart Outlook:

- The AUD/USD pair continues to face resistance around the 0.68 level, leading to a noticeable correction due to profit-taking at higher levels.

Key Level to Watch:

- Support: 0.67 area (previously the upper boundary of a consolidation range)

- This level is crucial for maintaining the current uptrend.

Potential Scenarios:

- If 0.67 support holds:

- The Aussie may have room for further upside in the coming sessions.

- If 0.67 support breaks:

- The AUD/USD pair could fall back into its previous consolidation range.

Outlook for Traders

- Keep a close eye on the 0.67 support level, as it’s key to determining the pair’s short-term direction.

- Monitor upcoming economic data releases from both Australia and the US, as they could significantly impact the pair’s movements.

- Watch for any developments in US-China relations or changes in commodity prices, as these factors can have a strong influence on the Aussie dollar.

- Stay informed about any shifts in RBA or Fed policy expectations, as these continue to play a crucial role in the AUD/USD pair’s performance.

Remember, forex markets can be volatile and are influenced by a wide range of factors. Always use proper risk management techniques when trading, and stay informed about relevant economic news and data releases from both Australia and its major trading partners.