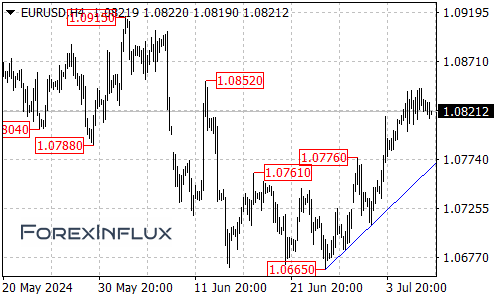

Since last week, the euro has shown strength against the dollar, largely due to the greenback’s retreat. Yesterday, this upward trend continued, with the EUR/USD pair reaching a high of 1.0844.

Key Factors Influencing the Euro

- Monetary Policy Expectations:

- The market’s changing expectations regarding US and European monetary policies remain the primary driver of the euro’s performance.

- Eurozone Economic Data:

- July’s Sentix Investor Confidence Index for the Eurozone dropped significantly to -7.3, its lowest in four months.

- May retail sales in the Eurozone grew by 0.1% month-on-month, below the expected 0.2%.

- These figures suggest that the Eurozone’s economic recovery remains fragile.

- Central Bank Actions:

- The European Central Bank (ECB) cut rates by 25 basis points in its June meeting.

- Markets expect approximately two more rate cuts from the ECB this year.

- Comparison with the US Federal Reserve:

- As US economic growth slows and inflation cools, expectations for two Fed rate cuts this year are strengthening.

- The previously divergent policy expectations between the ECB and Fed are now converging, providing some support for the euro.

Current Situation and Short-term Outlook

- Economic Fundamentals:

- The basic scenario of a strong US economy versus a weaker Eurozone economy remains unchanged.

- This continues to put pressure on the euro in the short term.

- Trading Range:

- The euro is likely to maintain a fluctuating trend within the 1.07-1.09 range.

Key Takeaways for Traders

- While the euro has shown recent strength, underlying economic challenges in the Eurozone persist.

- The convergence of monetary policy expectations between the US and Eurozone is providing some support for the euro.

- Short-term outlook suggests continued fluctuation within a defined range.

- Keep an eye on upcoming economic data and central bank communications, as these could influence the pair’s direction.

Remember, forex markets can be volatile and are influenced by a wide range of factors. Always use proper risk management techniques when trading.