Recent Performance

On Thursday, July 4th, the AUD/USD pair continued its upward trajectory, closing 0.3% higher at 0.6727. This marks the second consecutive day of gains for the Australian dollar against the US dollar.

Key Factors Driving the Trend

- Weak US Economic Data:

- Wednesday’s release of softer US economic indicators has increased expectations for potential Fed rate cuts.

- Diverging Central Bank Outlooks:

- The differing rate outlooks between the Reserve Bank of Australia (RBA) and the Federal Reserve are providing support for the AUD/USD pair.

- Notably, Australian 10-year bond yields are currently higher than their US counterparts.

- Commodity Prices:

- Rising commodity prices, particularly iron ore reaching a one-month high on Thursday, continue to bolster the Australian dollar.

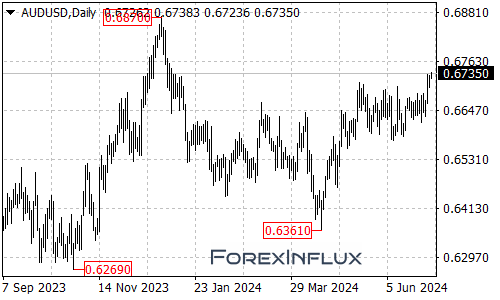

Technical Analysis

The daily chart shows promising signs for AUD bulls:

- Breakout:

- AUD/USD has broken above the 0.67 resistance level, which was previously the upper limit of a consolidation range.

- Confirmation:

- Closing prices have remained above this level for two consecutive trading days, indicating increased bullish sentiment.

Key Levels to Watch

Resistance:

- Initial resistance: 0.6730-35 (corresponds to daily highs from January 8-12)

- Further resistance: 0.6749 (76.4% Fibonacci retracement of the December to April downtrend from 0.6870 to 0.6361)

Support:

- Initial support: 0.6700-05

- Further support: 0.6675-80

Outlook

The AUD/USD pair is showing signs of bullish momentum, supported by a combination of economic factors and technical indicators. Traders should keep an eye on upcoming economic data releases and central bank communications, which could further influence the pair’s direction.

Remember to always use proper risk management techniques when trading, as currency markets can be volatile and subject to rapid changes based on various economic and geopolitical factors.