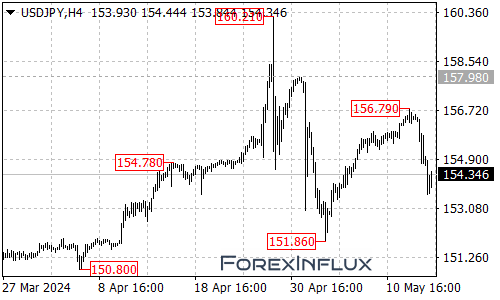

The USD/JPY currency pair has witnessed a significant extension of its upside move, rallying from the 151.86 level to as high as 156.79. However, the subsequent pullback from this high is likely a corrective move within the broader uptrend, suggesting that another rally towards the 158.00 area could be on the cards after the current correction phase concludes.

On the upside, the initial resistance for the USD/JPY is currently situated at the 155.00 level. A decisive break above this level could potentially trigger further upside momentum, potentially leading the pair towards the previous high of 156.79.

If the USD/JPY manages to surpass the 156.79 resistance, the focus would shift towards the 158.00 area, which could act as a significant target for the bulls.

However, it’s important to note that the path higher may not be without obstacles. As long as the 155.00 resistance holds firm, the current downside move from the 156.79 high could potentially continue, with the next target for the bears being around the 153.00 level.

Should the USD/JPY break below the 153.00 level, it could potentially expose the 151.86 support, which could act as a significant level for the bears to defend.

In summary, the USD/JPY has extended its rally, reaching as high as 156.79 before witnessing a corrective pullback. While this correction is underway, traders are eyeing the potential for another upside move towards the 158.00 area.

On the upside, the 155.00 and 156.79 levels will likely act as resistance zones, while on the downside, the 153.00 and 151.86 levels could serve as potential support areas.

Traders and investors are advised to closely monitor the price action around these crucial levels to gauge the potential direction of the USD/JPY in the coming days.