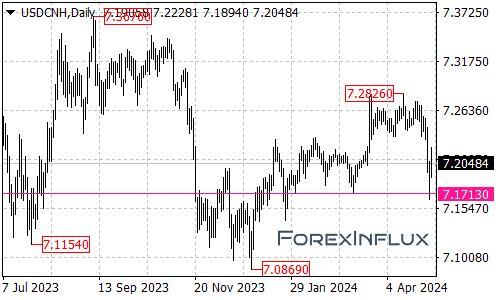

The USD/CNH currency pair has witnessed a significant bearish development, breaking below the critical 7.1713 support level. This breakdown suggests that the recent upside move from the 7.0869 low has likely completed at the 7.2826 high.

With this bearish signal, further declines in the USD/CNH could be on the horizon in the coming days and weeks. The next target for the bears is the 7.1450 level, followed by the 7.0869 previous low.

If the selling pressure persists and the USD/CNH breaches these levels, it would indicate that the long-term downtrend from the 7.3676 high has potentially resumed. In such a scenario, another decline towards the 6.700 level could potentially be witnessed.

However, it’s important to note that the path lower may not be without obstacles. The initial resistance level for the USD/CNH is currently situated at the 7.2360 area. If the pair manages to regain strength and break above this level, it could potentially trigger further upside momentum, potentially leading to a retest of the 7.2826 resistance.

A sustained move above the 7.2826 level could potentially shift the focus towards the 7.3600 zone, potentially signaling a continuation of the previous uptrend.

In summary, the USD/CNH has broken through a crucial support level, suggesting that the recent upside move may have concluded. The pair is now facing potential downside risks, with the 7.1450 and 7.0869 levels serving as the next targets for the bears. A breach of these levels could potentially signal a resumption of the long-term downtrend, potentially paving the way for a move towards the 6.700 level.

On the upside, traders should closely monitor the 7.2360 and 7.2826 resistance levels, as a break above these levels could potentially negate the bearish outlook and potentially pave the way for a move towards the 7.3600 zone.

Traders and investors are advised to stay vigilant and adapt their strategies based on the evolving price action in the USD/CNH currency pair.