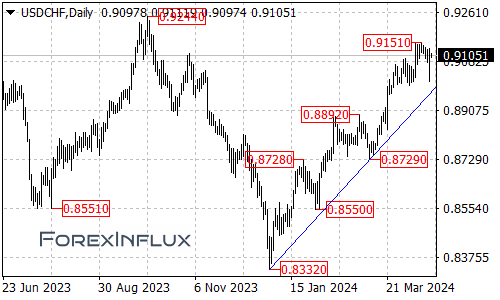

The USDCHF currency pair continues to trade above a rising trendline visible on the daily chart timeframe. This technical development suggests that the broader uptrend from the December 2023 low at 0.8332 remains firmly intact for now.

As long as USDCHF can continue finding support from that rising trendline, the recent pullback from the 0.9151 high is likely nothing more than a consolidation within the overarching bullish trend. Holding trendline support would leave the door open for a potential resumption of gains after the current pause.

Should the consolidation resolve higher, a breakout above the 0.9151 resistance level could open the path for USDCHF to target the next key upside objectives. The first level to watch on further strength is the 0.9240 handle, followed by the more significant 0.9350 zone.

However, traders will want to keep a close eye on the rising trendline support in the coming days and weeks. Only a clear break below that trendline would raise concerns that the upside move from the 0.8332 December low has potentially completed already at the 0.9151 high.

In that scenario of a trendline breakdown, the USDCHF rally would likely encounter initial support around the 0.8850 level. Any further downside follow-through could then bring the 0.8750 area into focus as the next key target.

For now, the overall technical bias remains tilted in favor of the bulls as long as USDCHF holds above that rising trendline on the daily chart. Traders will be watching for a potential breakout above 0.9151 resistance to confirm the uptrend has potentially resumed, or alternatively, a trendline violation to signal that a deeper correction towards 0.8850 or 0.8750 may be underway.

The key levels to monitor are the rising trendline support for signs of a bullish continuation and the 0.9151 resistance area for a potential upside breakout. On the other hand, a trendline breakdown would mark a significant bearish event that could open the door for a larger corrective phase within the rally from last December’s 0.8332 low.