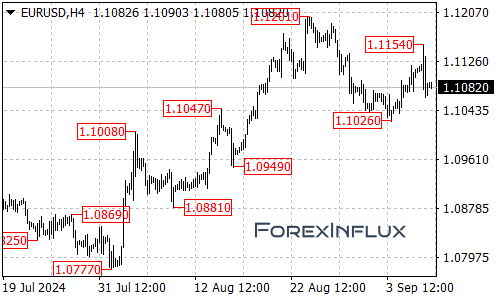

The EURUSD has been on quite a journey lately. We’ve seen a significant upward move from 1.1026, pushing all the way up to an impressive high of 1.1154. However, as often happens in the forex market, what goes up must come down – at least temporarily.

Signs of a Completed Upward Move

The recent pullback from the 1.1154 level is giving traders pause. This retracement suggests that the upward move we’ve been watching may have run its course, at least for now. It’s a signal that savvy traders are keeping a close eye on.

What’s Next? Potential Downside

Given the current market dynamics, we’re likely to see further downward movement in the coming days. Here’s what traders should be watching:

- Key Support Level: The immediate target to watch is the 1.1026 support level. This is a crucial point that could determine the pair’s short-term direction.

- Breaking Lower: If the pair breaks below 1.1026, we could see it push towards the psychologically important 1.1000 area. This round number often acts as a significant level for traders.

Upside Potential

While the current outlook leans bearish, it’s always important to consider both sides of the market. Here’s what to watch for if the bulls regain control:

- Resistance to Watch: The 1.1110 level is acting as initial resistance. This is the first hurdle the pair needs to clear for any upward movement.

- Potential for Another Rally: A break above 1.1110 could trigger another rise. In this scenario, we might see the pair retest the recent high of 1.1154.

Conclusion

The EURUSD pair is at an interesting juncture. While the short-term outlook suggests a potential for further downside, the forex market is known for its ability to surprise. Keep a close eye on the key levels mentioned, and always remember to trade with proper risk management.