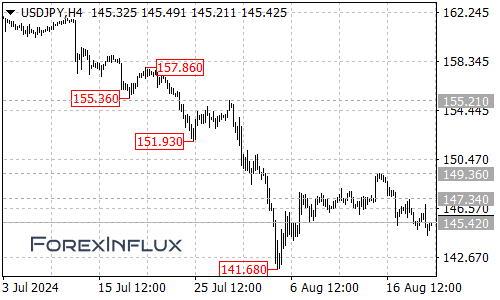

USDJPY has been in decline, falling from a high of 149.36. The pair recently touched a low of 144.45.

Short-Term Outlook:

- The current downward movement could continue as long as the price stays below the 147.34 resistance level.

- If this trend persists, we might see the pair test the 143.60 area next.

Big Picture View:

- It’s important to note that this decline is likely a correction within a larger uptrend that started at 141.68.

- This suggests that after this correction plays out, we might see another push higher.

Key Levels to Watch:

- Resistance: 147.34

- A break above this level could signal that the uptrend is resuming.

- If breached, the next target would be the previous high of 149.36.

- Further Upside Potential:

- If the pair manages to climb above 149.36, it could potentially aim for the 152.00 area.

What This Means for Traders:

- Short-term traders might look for further downside, keeping an eye on the 143.60 level.

- Longer-term traders should be prepared for a potential resumption of the uptrend, especially if the price breaks above 147.34.

Remember, forex markets can be volatile, so always use proper risk management techniques in your trading.