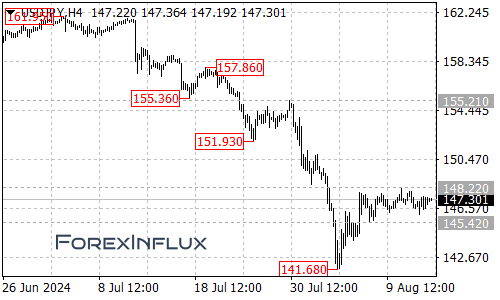

The US Dollar to Japanese Yen exchange rate (USD/JPY) has been in a consolidation phase recently. Let’s break down what’s happening and what it could mean for traders in the near future.

Current Situation USD/JPY has been trading sideways for several days, bouncing between two key levels:

- Support: 145.42

- Resistance: 148.22

This range-bound movement could be seen as a pause in the larger uptrend that started from the 141.68 level.

Potential Bullish Scenario If the pair manages to break above the 148.22 resistance, we could see a significant move higher. Here’s what to watch for:

- Immediate Target: 150.00 This psychologically important level could be the first stop if we see a breakout.

- Further Upside: 151.85 If momentum continues, this could be the next major target for bulls.

Potential Bearish Scenario While the overall trend has been upward, there’s always the possibility of a reversal. Here’s what bears should look for:

- Key Support: 145.42 A break below this level could signal a shift in momentum.

- Next Support: 144.00 If 145.42 breaks, this could be the next level to watch.

- Major Support: 141.68 This is the previous low. A fall to this level would likely indicate a significant trend reversal.

Trading Implications

- For Bulls:

- Look for a decisive break above 148.22 as a potential entry point.

- Consider setting targets around 150.00 and 151.85.

- For Bears:

- Watch for a break below 145.42 as a potential shorting opportunity.

- Key targets would be 144.00 and potentially 141.68 if the downward move gains momentum.

Key Takeaways

- USD/JPY is currently consolidating between 145.42 and 148.22.

- A break above 148.22 could lead to a move towards 150.00 and beyond.

- A fall below 145.42 might signal a deeper pullback or potential trend reversal.

- The overall trend remains bullish as long as the price stays above 145.42.

Remember, forex markets can be volatile, especially with potential interventions in the yen market. Always use proper risk management techniques and stay informed about economic events and central bank actions that could impact currency movements.

We’ll continue to monitor USD/JPY and provide updates as the situation evolves. Happy trading!