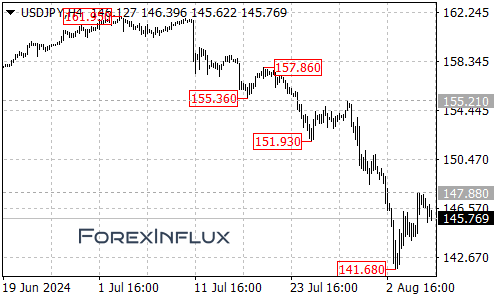

On Wednesday, August 7, the yen briefly dropped to a daily low of 147.88 against the US dollar. This decline followed remarks from Bank of Japan (BOJ) Deputy Governor Shinichi Uchida, who is a highly influential figure within the central bank. Uchida stated that “given the significant volatility in domestic and international financial markets, it is necessary to maintain the current level of loose monetary policy.” His comments downplayed the likelihood of a near-term rate hike, easing investor concerns that a further sharp rise in the yen could disrupt global markets.

This development has tempered the yen’s recent strong recovery, which had caused some jitters among investors. Looking ahead, two key factors will be critical: whether the Federal Reserve decides to start cutting rates soon, and whether the Bank of Japan continues with rate hikes and tapering its bond purchases. Both of these factors could significantly influence the yen’s trajectory.

From a technical standpoint, the yen’s depreciation from the beginning of this year to July (from 140.25 to 161.95) has nearly completed a 100% retracement. The recent oversold condition could trigger a short-term correction, possibly leading to some short covering. However, the overall market trend has shifted, making it unlikely that the yen will return to the kind of sharp depreciation trend seen earlier this year. After a potential adjustment, the yen might continue to move back toward its value equilibrium.

Conclusion

While the yen’s rapid rise has slowed, future movements will largely depend on the actions of the Federal Reserve and the Bank of Japan. Although a short-term correction is possible due to the recent oversold conditions, the yen may still have room to move closer to its value center after the adjustment period.