On Monday, July 29, the Australian Dollar (AUD) saw a slight uptick against the US Dollar (USD), rising 0.02% to 0.6548. This move represents an attempt to recover from Friday’s low of 0.6510.

Key Upcoming Event

The market’s focus is now on Australia’s Q2 inflation report, scheduled for release on Wednesday. This report is crucial as it could influence the Reserve Bank of Australia’s (RBA) decision on interest rates in August.

Inflation Expectations and Rate Hike Probability

- Current market pricing suggests a 20% probability of a rate hike in August.

- Economists predict a slight increase in overall inflation.

- More importantly, core inflation (trimmed mean) is expected to remain steady at 4.0% year-over-year.

- If realized, this could increase pressure for monetary tightening.

Expert Opinion

Blair Chapman, Senior Economist at ANZ Bank, suggests:

“Even if Q2 CPI comes in slightly above the RBA’s forecast, we believe the central bank will overlook some ‘uncontrollable’ inflation and maintain the overnight cash rate at 4.35% in the August meeting.”

Potential Scenarios

Base Case: Rates Unchanged

- The RBA is likely to keep interest rates steady at 4.35% in August.

- Even if inflation rises, any boost to the AUD is expected to be short-lived and limited.

Bullish Case: Inflation Surprise

- A significant inflation surprise could increase rate hike expectations.

- However, sustained AUD strength would likely depend more on the Federal Reserve’s stance on potential September rate cuts.

Technical Outlook

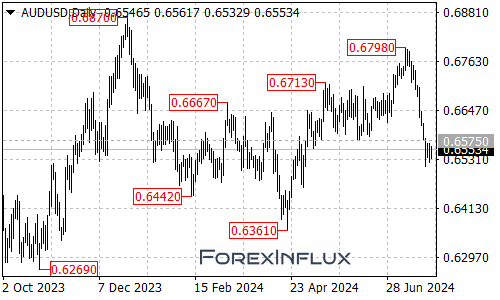

- AUD/USD continues to consolidate in a lower range on the daily chart.

- Ahead of major economic events from various key economies this week, AUD/USD is expected to trade in a narrow range.

- The primary trading range is likely to be between 0.65 and 0.66.

Conclusion

The AUD/USD pair is at a critical juncture, with the upcoming inflation data potentially setting the tone for future movements. While a rate hike in August seems unlikely, a surprise in inflation figures could cause short-term volatility.

Traders and investors should keep a close eye on Wednesday’s inflation report and subsequent RBA communications. However, it’s important to note that the broader trend for AUD/USD will likely be influenced more by global factors, particularly the Fed’s stance on future rate cuts.

As always, consider broader economic indicators and geopolitical events when trading AUD/USD, and implement proper risk management strategies.