On Monday, July 8th, the USD/JPY pair closed slightly higher at 160.76, up 0.02% in New York trading. This minor gain was primarily due to some short covering after the dollar index’s decline last Friday.

Key Economic Developments

- Japanese Wage Growth:

- Data released on Monday showed Japanese workers’ average base pay increased by 2.5% in May, the fastest growth in 31 years.

- Bank of Japan’s (BoJ) Stance:

- The BoJ noted that wage increases are spreading across the economy due to tight labor market conditions.

- This suggests the central bank believes Japan is moving towards sustainably achieving its 2% inflation target.

- The optimistic assessment may strengthen the case for a rate hike at the BoJ’s next meeting on July 30-31.

- Potential Rate Hike:

- Some analysts believe the BoJ is getting closer to a rate hike window, possibly at this month’s meeting or the next.

Technical Analysis

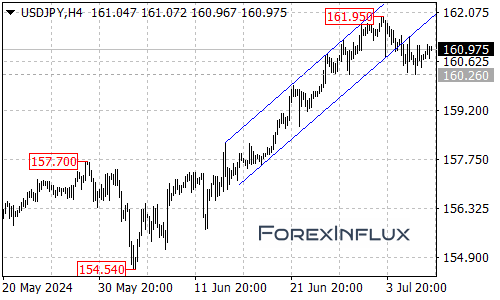

- Resistance Levels:

- Selling pressure from exporters and profit-taking at higher levels is currently capping the USD/JPY around 161.00 or slightly above.

- Recent Price Action:

- Since reaching a 38-year high last Wednesday, the pair has been experiencing a correction due to profit-taking at higher levels.

- The price is still holding above 160, which isn’t enough to indicate a reversal in the USD/JPY’s uptrend yet.

- Key Support Level:

- A significant reversal would only be likely if the pair falls below 158, which was the starting point of this recent upward move.

Outlook and Key Points for Traders

- The USD/JPY pair is currently in a holding pattern, with potential for movement in either direction.

- Watch for any signs of the BoJ shifting towards a more hawkish stance, which could support the yen.

- Keep an eye on the 161.00 resistance level and the 158.00 support level for potential breakouts or reversals.

- upcoming economic data releases and central bank communications could significantly impact the pair’s direction.

Remember, the USD/JPY pair can be particularly sensitive to changes in US Treasury yields, BoJ policy decisions, and overall risk sentiment in the market. Always use proper risk management techniques when trading.