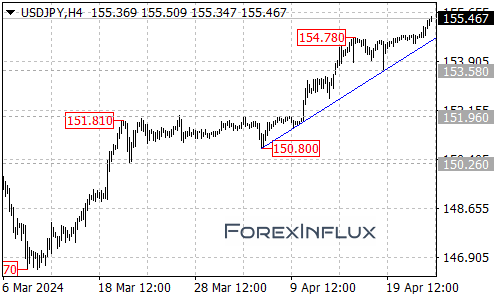

The USDJPY currency pair has made a bullish technical breakthrough by surging above the 154.78 resistance level. This move has extended the recent upside advance from the 150.80 low, with the pair now reaching as high as 155.51.

As long as USDJPY remains trading above the rising trendline visible on the 4-hour chart timeframe, the overall technical bias will remain tilted in favor of the bulls. With the path of least resistance still appearing to be higher, the next key upside target in traders’ sights is the 157.00 handle.

In the near-term, the first meaningful support for USDJPY has arrived at the 155.00 level. Any dips toward this area could potentially present buying opportunities for traders looking to position in line with the newly-established bullish momentum.

However, a breakdown below 155.00 would be an initial signal that the upside move may be stalling. Such a scenario could see USDJPY revisiting a test of the rising 4-hour trendline support next. A violation of that trendline would mark an even more significant bearish development.

Specifically, a trendline breakdown below support could indicate that a lengthier period of consolidation within the broader uptrend from the 146.47 low may be unfolding. In that case, the next key downside target for USDJPY would arrive around the 153.58 support area.

For now, the path of least resistance seems to be a continuation higher for as long as USDJPY holds above the noted 155.00 support and rising 4-hour trendline. The focus will be on whether the currency pair can extend its gains beyond the 157.00 resistance zone next.

But traders will want to keep a close eye on the 155.00 and rising trendline support levels for any signs that the bullish momentum may be fading. A loss of those key floors would potentially open the door for a more substantial corrective pullback within the larger uptrend from the March lows around 146.47.