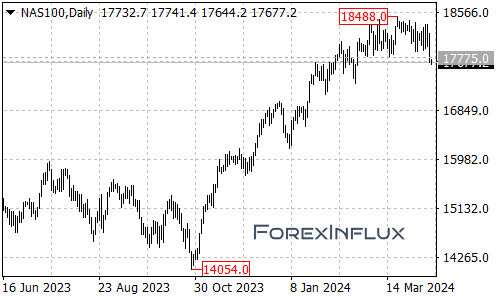

The Nasdaq 100 index (NAS100) has taken a bearish technical turn by breaking below the key 17775 support level. This breakdown suggests that the prior upside move from the 14054 low may have already completed at the 18488 high printed earlier this year.

With the breakdown below such a significant floor, further NAS100 declines could potentially be in store over the next several weeks. The next major target area that bears will be eyeing is the 16600 zone.

However, it’s important to keep in mind that the selloff from the 18488 peak could ultimately represent a consolidation within the longer-term uptrend that has been tracking from the 10437 low in 2022. If this is simply a corrective phase, another rally higher could emerge after the current downswing runs its course.

In the near-term, the first meaningful resistance arrives at 18200. A reclaim above 18200 could open the door for a stronger recovery move to retest the 18488 high next.

That said, only a decisive breakout above 18488 would confirm that the larger uptrend has resumed. Anything less than that will leave the NAS100 stuck in the newly-established downtrend from the 18488 top.

While the technical damage below 17775 support is concerning for the index’s near-term trajectory, traders will want to see if the selloff finds support around the 16600 area or if an even deeper correction towards the 2022 uptrend could potentially be in the works.

For now, the path of least resistance appears to be a continuation lower for the NAS100, but the bulls will be looking for signs that the current downswing is simply setting the stage for another leg higher in the longer-term uptrend.