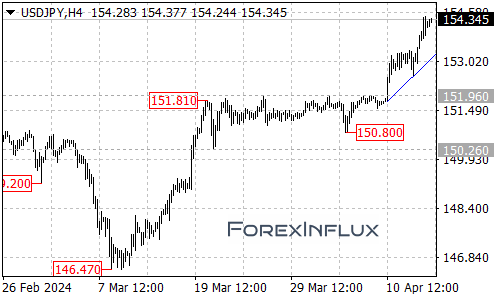

The USDJPY currency pair has continued to exhibit strong bullish momentum, with the recent upside move from the 150.80 low extending all the way up to 154.44 so far.

As long as USDJPY remains trading above the rising trendline visible on the 4-hour chart timeframe, the path of least resistance appears to be for further gains. The next key target in focus for the bulls is the 156.00 handle.

In the near-term, the first meaningful support level to watch is at 153.65. Only a breakdown below 153.65 would introduce some near-term bearish friction, potentially opening the door for a pullback towards the rising trendline support on the 4-hour chart.

A move beneath that trendline support would be an even more significant technical event. It could mark the start of a consolidation phase within the longer-term uptrend that has been tracking from the 146.47 low. In that scenario, USDJPY may find itself drawn towards more substantial support around the 152.00 area.

However, as long as the currency pair holds above the rising 4-hour trendline, the overall technical bias will remain tilted in favor of the bulls targeting a potential extension towards the 156.00 resistance zone.

USDJPY traders will want to keep a close eye on the 153.65 and rising trendline support areas in the coming sessions. Any dips towards those levels could present potential bullish opportunities for momentum traders looking to position in line with the dominant uptrend.

Unless the trendline and 153.65 support areas are violated, the path of least resistance appears to be for a continuation higher in USDJPY with 156.00 as the next key upside target.